In a new article recently published in New Political Economy, DEEPEN team members Philipp Golka and Natascha van der Zwan investigate the link between financial valuation and institutional change through recent dynamics of pension fund governance in the Netherlands.

The Netherlands has century-old institutions of representing social partners (employers, employees, pensioners) in the governance of pension funds. However, a new law in 2012 allowed pension funds to introduce financial experts to pension fund boards – either by adding them to traditional models of representational governance, or through new models where experts take center stage.

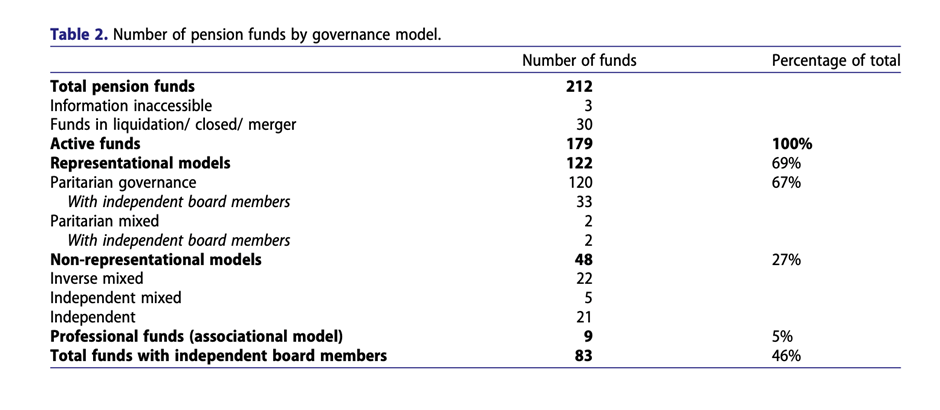

At first sight, the Dutch pension system shows institutional resilience in the face of a changing legislative environment as 69% of Dutch pension funds still use representational models. However, the empirical analysis of board composition of all Dutch pension funds shows that an important transformation is increasingly taking place from within. As of 2020, nearly half (46%) of Dutch pension funds feature independent board members.

To explain the rise of financial experts, the article draws on the linked ecologies framework developed by Abbott (2005). This framework provides two important analytical concepts: hinges are projects that make professional groups in different institutional spheres dependent on the same outcome. Avatars are institutionalized hinges where one group is reproduced within another professional group.

In the mid 2000s, an important hinge between the financial world of pension funds as well as the political sphere of pension policy has been developed. In 2007, the Dutch government made pension entitlements dependent on a newly developed funding ratio based on market valuation of assets and liabilities. This created a hinge between pension funds and policy, as financial market swings would now translate directly into pension outcomes. As pension assets and liabilities plunged during the financial crisis in 2008-10, funding ratios rapidly declined, leading to unprecedented pension cuts. Indeed, due to historically low interest rates, funding ratios remained low even as asset levels grew almost threefold since 2009.

Dependent on financial expertise, policymakers invited economists and pension professionals to make sense of the crisis. This created an avatar of finance within the policy realm. As a result, the earlier idea to introduce financial experts as internal supervisors was transposed to strengthening expertise within pension fund boards. However, expertise was ascribed to financial actors by their social position, creating a false dichotomy that led to a gradual displacement of representative board members.

This study provides novel insights by showing how changes in financial valuation techniques can lead to larger institutional change. It shows how financial valuation can create dependencies between finance and policy that can be used as professional opportunities by experts who can claim respective proficiency. Importantly, the displacement effects elicited by the rise of financial experts should not be read as a growing financialization of the state. Rather, this dynamic bolstered state capacity in a previously corporatist domain as expertise requirements are defined by financial regulators.

The article “Experts versus representatives? Financialised valuation and institutional change in financial governance” has been published Open Access and can be found free of charge here: https://www.tandfonline.com/doi/full/10.1080/13563467.2022.2045927